Listen on the Podcast

I’ll be honest — I almost didn’t record this episode.

After talking about it with Andrea (my wife) and praying about it, we decided we were going to share more of our story.

This wasn’t easy. Not many people are willing to talk about the REAL life money.

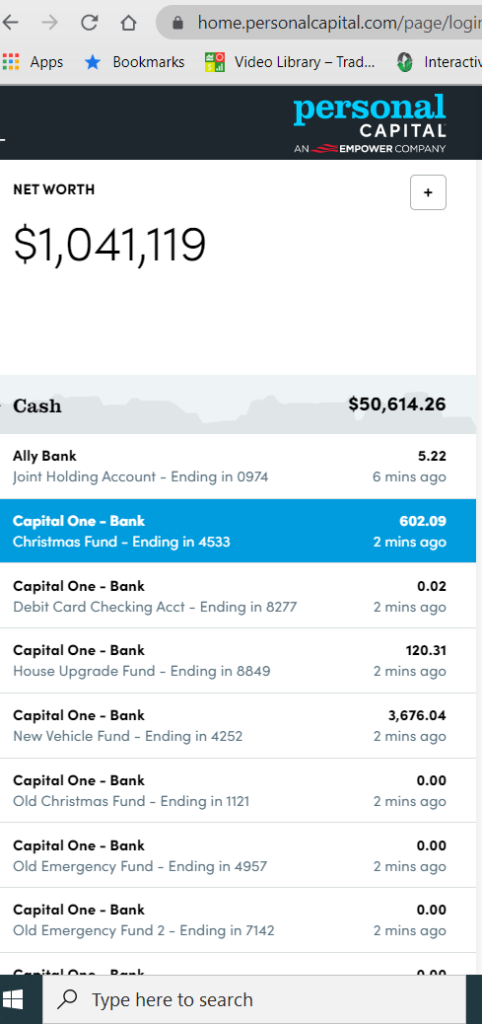

Here goes…this past month we officially passed $1 million net worth.

The definition of a millionaire is a person or a married couple whose net worth is greater than $1 million.

Chris Peach, Money Peach

And there is way more to the story that Andrea and I are sharing on the show today.

No, we do not make $1 million. (Not even close)

No, it did not happen quickly.

No, it wasn’t super easy.

No, we are nowhere near perfect when it comes to money.

However, we hit one of our goals. We can officially say we are “millionaires”. And it feels really damn good!

But, how did this happen?

Where did we start (Hint: we had a huge negative net worth)?

And how could someone else accomplish this?

#1: Track Your Net Worth

I remember hearing the average millionaire in America tracks their net worth. Since I wanted to move away from being broke and wanted to reach a net worth of a million dollars, I needed to start tracking my net worth.

It’s not rocket science. Simply just add up everything you owe (your liabilities) and deduct them from everything you have (your assets).

You liabilities are things like debt, mortgage balance, what you owe on your cars, credit cards, student loans, and really anything that you still have to pay a balance on.

Your assets on the other hand are things you own. This could be your 401(k), an investment property, the equity you have in your house.

Another simple way to do this is to try the Personal Capital app which is a free app that tracks your net worth for you in real time. This is what I currently use.

#2: Create on Budget

This is crucial. If you are not going to live on a written plan, then I would say don’t bother doing anything else below. A budget is the most important part of any good financial plan. It’s the reason we were able to pay off debt, stay out of debt, build wealth and eventually reach a $1 million net worth. You can grab my free budget here.

#3: Pay Off Consumer Debt and Stay Out of Debt

In order to start building wealth, we need to get debt out of our lives and then keep them out of lives. And I get it — it’s not easy. We are constantly bombarded with messages reminding us to go into debt. From commercials on television, to Facebook ads and even our own neighbors…debt is calling our names.

The absolute best way to pay off your debt is to use the debt snowball method.

#4: Invest as Much as You Possibly Can

I see a lot of gurus out there telling you to invest $19,000 per year. Others will tell you to invest $10,000, $25,000 or some other arbitrary number.

How about this — invest as much as you possibly can. Fifteen percent is a good baseline, but I also know people who invest 50% of their income. Sacrifice a little more now to invest more so you can live the life you dream of when you retire.

#5: Pay Off Mortgage Faster

I know, I know — “Chris, why would you pay off your mortgage when interest rates are so low?”

I hear this all the time and here is what I do know…mathematically you are 100% correct. But, I have interviewed many, many people with paid off mortgages and I have yet to meet anyone who told me they wished they still had a mortgage. In fact, the only people screaming to keep your mortgage are those with a mortgage.

Some of the best ways to pay off your mortgage are listed here.

#6: Stay Frugal

This one is one of the easiest things to start but one of the hardest things to do for a long period of time. And no, this doesn’t mean “cheap”, it means frugal.

Live on less than you earn. This way you can throw more at debt and invest more in the future. Don’t allow your lifestyle to creep up to the outer limits of your income. Remember, the cost between really good and the best is huge but the value is just about the same.

#7: Circle Back to Your Why

What is your why?

Determine your why and revisit it when things get rough. The truth is you and I are going to face some kind of financial setback in life. Maybe your job is eliminated or the stock market takes a dive after reports of COVID. We don’t know what is around the corner, but always be prepared to revisit your why.

The best time to revisit your why may be when things are amazing. When life is hitting on all cylinders and you have more money than you know what to do with, re-visit your “why”.

Links from the Show

- Free Net Worth Tracking Spreadsheet (From WalletHacks.com)

- Free App to Track Your Net Worth in Real Time (From Personal Capital)

A Budget is Required When Tracking Your Net Worth

A budget goes hand in hand with tracking your net worth. In order to determine how much you can throw at debt, invest, and increase your net worth, you must have a budget.

You can have the same one I use everyday (free).

Thanks so much for listening to the show and if you feel the content of this podcast was helpful, please subscribe to the podcast where you listen and leave a review!

Today’s show was brought to you by OneAZ Credit Union — my very own credit union I have been proud a member of since 2011.

If you live in Arizona and are looking for a large credit union with a local, customer-focused feel for your personal or business banking needs, look no further than OneAZ Credit Union.

2 Comments

You guys continue to inspire, love this episode SO much!!!!!!!!!!!!!! Thank you for being humble and sharing your wisdom. Thanks to you, gone are the credit cards, the car loans (yes 2 of them!), the 90k student loan debt and the trailer payment. On our way too and it sure feels amazing!

Chris you are so inspiring and all of your posts have such great research behind them. You can tell that you both are coming from having lived this and being truly committed to this lifestyle. You give me hope as well that by putting in the work this is possible.